The Magic of Compound Interest: The Path to Financial Freedom

Compound interest is considered one of the most powerful financial tools due to its ability to multiply capital exponentially. When invested money earns income, and that income is continually reinvested, new interest is accrued not only on the original investment but also on the accumulated income. This creates a “snowball” effect, thanks to which even small investments can grow significantly over time, especially if you start investing early.

The Magic of Compound Interest:

- Key Facts About the Power of Compound Interest

- Things to Consider

- Why You Should Start Investing

- The Best Strategy

- Conclusion

This power of compound interest makes investing profitable at any age and with any amount. For example, if you start investing even with a small amount at a young age, over time this investment can grow to significant amounts, even without additional investments. For those who start investing later, the effect of compound interest also works, although it may require more regular replenishment for maximum results. Such a strategy is the basis for achieving financial goals, because by reinvesting interest, capital can grow much faster than with fixed income.

Regardless of the starting amount, investing with the effect of compound interest helps create a financial cushion and achieve greater freedom.

Here are some key facts that reveal the power of compound interest:

1. Exponential growth of capital. Compound interest works on the principle of "interest on interest": each time interest is accrued not only on the initial amount, but also on the income received in previous periods. This allows money to grow faster than with fixed interest.

2. Starting early is of great importance. Thanks to the effect of compound interest, even small investments made at a young age can reach significant amounts over time. For example, an investment for 30 years provides a higher income than a similar amount invested for 20 years, even at the same annual interest rates.

3. Time is a key factor. The longer the investment lasts, the greater the effect of compound interest. Even small contributions can grow significantly over a long period. Time compensates for market fluctuations and makes investments resistant to short-term risks.

4. Small amounts also matter. The power of compound interest is especially useful for those who don't have a large initial investment. Even with small contributions, combined with regular investing and reinvestment, capital can grow to a significant amount over time.

5. Reinvesting Income. To take full advantage of compound interest, you need to reinvest all income rather than withdrawing it from your account. This helps accelerate capital growth and increase returns.

6. Financial Independence. Using compound interest helps people achieve financial independence by providing passive income over the long term. It is the foundation for building a stable financial future.

Applying compound interest to long-term investments, such as retirement savings, portfolio investments, or savings, is the most common strategy used by financial advisors to help clients achieve their financial goals.

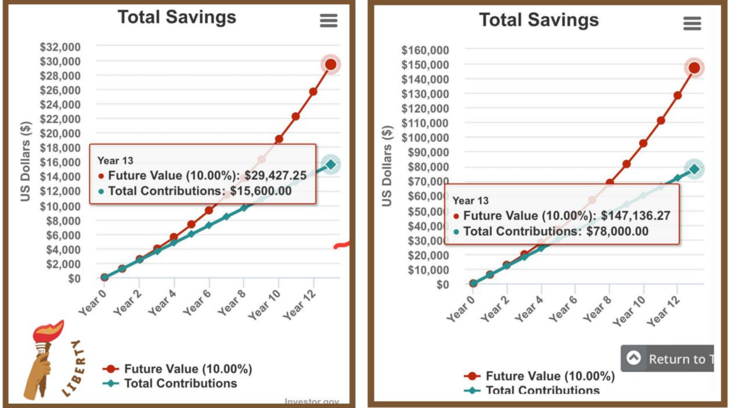

On the SEC compound interest calculator, the results of which are displayed in the photos, you can see what will happen to your investment in in 13 years. With a high probability, the amount you invested will double.

If you invest $100/month consistently for 13 years, you will save a little over $15,000 and receive almost $30,000.

With a contribution of $500/month:

Invested: $78,000

Received: about $147,000, which will allow you to live on your investment for every subsequent year for exactly $500/month.

To make the most of compound interest, it is important to consider several key factors:

1. Investment timeframe. The longer the money stays invested, the greater the compound interest effect. This means that investing early has an advantage because it gives you more time to accumulate interest on your previous income.

2. Interest compounding frequency. The frequency with which interest is compounded (monthly, quarterly, annually) affects your overall income. More frequent compounding provides a greater compound interest effect because interest is added to the principal more often.

3. Interest rate. A higher interest rate significantly increases your total income, because with compounding, even a small increase in the rate can significantly affect the final amount.

4. Reinvestment of income. To maximize the effect of compound interest, you need to reinvest all income instead of withdrawing it. This allows you to receive interest not only on the initial capital, but also on the entire accumulated amount.

5. Investment costs. Asset management fees or other additional costs can reduce the effect of compound interest, especially for long-term investments. It is important to consider these costs to minimize their impact on income.

6. Inflation. Inflation can reduce the real value of income received, so it is worth considering this factor when choosing investment instruments with higher returns that can exceed the rate of inflation.

Proper understanding of these factors helps to increase investment returns and ensure stable capital growth through compound interest.

Investing is worth it for several key reasons, and this decision can be beneficial regardless of age or the size of your starting capital.

1. Capital accumulation and financial independence. Investing helps you accumulate capital, which allows you to achieve your financial goals faster. Having a stable source of investment income can create a financial cushion for future needs, from saving for retirement to large purchases or investing in your children’s education.

2. Protection against inflation. Inflation reduces the purchasing power of money over time. Investing in assets that earn income above the rate of inflation helps protect the real value of capital by preserving and growing your savings.

3. Harness the power of compound interest. The earlier you start investing, the more time your money has to grow through compound interest. Even small regular contributions can grow significantly over time as earnings are reinvested, creating a “snowball” effect.

4. Achieve financial goals. Investing can be an important tool for achieving specific goals, such as building a vacation fund, saving for your own business, or generating passive income. Choosing different asset classes can help you create a balanced portfolio that meets your needs.

5. Variety and diversification. Investments allow you to distribute funds between different types of assets, such as stocks, bonds, real estate or gold. This reduces risks and increases the stability of the portfolio, because losses in one area can be offset by income in another.

6. The ability to start with any amount. Modern financial instruments and access to online brokers allow you to start investing even with small amounts. This opens the door to investments for a wide range of people and allows you to develop investment skills with minimal risks.

Investments are the path to a stable financial future and the opportunity to take control of your capital, providing protection from external economic changes and a better quality of life in the future.

The optimal investment strategy depends on your financial goals, risks, investment horizon, and personal preferences. Here are some basic strategies that can be adapted to suit different needs:

1. Long-term investment strategy. Investing in stocks, bonds, and funds over the long term allows you to earn returns from asset growth and compound interest. This strategy requires patience, but can provide steady income, even during market fluctuations. A popular method is to buy index funds, such as the S&P 500, which provide broad diversification.

2. Diversified portfolio. A diversification strategy spreads assets across different categories, such as stocks, bonds, real estate, and even gold. This helps reduce risk because losses in one sector can be offset by gains in another.

3. Dollar Cost Averaging (DCA). This strategy involves regularly investing the same amount in certain assets regardless of market conditions. DCA allows you to reduce the impact of volatility and reduce the risk of investing in high points of the market, which over time creates a more profitable average value of assets.

4. Investing in dividend stocks. This approach is suitable for those who want to receive stable passive income. Investing in companies that consistently pay dividends allows you to receive regular income that can be reinvested or used for personal needs.

5. Balanced 60/40 Strategy. A classic investment strategy that involves dividing the portfolio into 60% stocks and 40% bonds. This allows you to combine the potential income from stock growth with the stability of bonds. Although this strategy may be less profitable during periods of high market growth, it is suitable for investors looking for moderate risk and stable income.

6. Adaptive approach. This strategy involves regularly reviewing and adjusting the portfolio depending on changing personal goals, economic conditions and market trends. Investors can increase the share of stocks in years of market growth or add bonds in times of instability.

So our conclusion about investing sounds positive, but here are a few additional aspects that can complement it:

1. The importance of education. Investing is not just about money, it is also about knowledge. An educated investor who understands the basics of financial markets can better manage risks and make informed decisions. It is recommended to regularly read books, articles and take financial literacy courses.

2. The psychological aspect. Investing also requires control over emotions. Market fluctuations can trigger fear or greed, which leads to impulsive decisions. It is important to have a clear plan and stick to it, even in difficult times.

3. Regular portfolio review. Your portfolio needs to be reviewed periodically to ensure it is in line with your financial goals and risk appetite. Changes in the economy, market, or your personal situation may require adjustments to your strategy.

4. Diversification. One of the key principles of investing is diversification. You shouldn’t invest all your money in one asset or type of investment. Having a variety of assets in your portfolio can reduce risk and provide more consistent income.

5. Length of investment horizon. Your investment goals and risk appetite should determine your investment horizon. Short-term goals may require a more conservative approach, while long-term goals may allow you to take more risk for higher potential returns.

6. Constant monitoring and adaptation. Investing is a dynamic process, and it is important to be prepared to adapt your strategy to changes in the market, the economy, and your own circumstances. This may include reallocating assets or changing investment vehicles.

Overall, strategic planning, learning, and adaptability are key components of successful investing. This approach will help not only preserve capital, but also grow it in the long term.